SA40. High Land Prices and Rural Unemployment, by Duncan Pickard

There is an almost universal belief by farmers that high land prices are beneficial to farming. I contend that high land prices are a curse on farming. I do not deny that some landowning farmers become very rich from high prices, but only when they sell, most of them making more money from selling their farms than they did throughout the time they were farming. There is a clear distinction between what is beneficial to a few farmers and what might be beneficial to farming in general and especially to those who want to farm but have no land.

In Scotland the average price of farmland is more than £4000 per acre and has increased by 17% in the last year. The average price of arable land is £8000 per acre. The market price of land is much more than can be justified by its productive capacity. Taking as an example land for growing wheat which is capable of yielding 3 tonnes per acre:- the current price of wheat ex farm is less than £120 per tonne which gives a gross income of under £360 per acre, the current cost of growing wheat is about £115 per tonne or £345 per acre, leaving a surplus of £15 per acre.

With arable land at £8000 per acre and the cost of borrowing at about 4%, the annual interest cost is £320 per acre, clearly unaffordable at current wheat prices. The price of wheat would need consistently to be £250 per tonne to justify a purchase price for arable land of £8,000 per acre. The traditional method for estimating the price of a farm which would enable the purchaser to fund a mortgage and to make a living from the farm puts the price of a farm at 20 times its rent. This was the basis of the price we paid for our farm in 1992. It was also the basis for the price we paid for the first piece of farmland we bought in 1975. The RICS (Royal Institute of Chartered Surveyors) Land Market Survey (2015) states that the average rent of arable land is £85 per acre which means its purchase price should be £1700 per acre. The current acreage price of £8000 is 4.7 times more expensive than its productive capacity would justify and its rent would be £400 per acre.

Why is the market price of farmland so high?

- The rising price of farmland is attractive to non-farmers who have money to invest. They are not concerned with the land’s productive capacity, they are hoping for increases in its price.

- Farmland is favourably treated for taxation; Inheritance tax and Capital Gains Tax are avoidable and “farmland is an efficient asset for the transfer of wealth”

- Farmers buy about half of the land offered for sale. Those who own their farms free of debt can afford more land by averaging the cost of new borrowing over the whole of their enlarged farms.

- Landowning farmers who receive non-means-tested income support in the form of subsidies which are surplus to requirements invest in more land and thereby increase their subsidy income.

- Rent-seeking banks persuade owner-occupiers with no mortgage to buy more land.

What are the disadvantages of high farmland prices?

- Young newcomers to farming are prevented from buying land unless they have access to money from elsewhere.

- There is an effective monopoly in farmland purchasing when only those who already own land are able to buy, which results in large farms becoming larger, and smaller farms becoming fewer.

- Landowners are unwilling to offer land for rent except on short leases because land which is subject to a long term tenancy has a market price which is about half that of freehold land.

- Landowners are unwilling to sell farms to their long-lease tenants because the price differential means that the tenants could make a substantial financial gain by selling at the freehold price.

- If The Absolute Right to Buy is introduced, tenants could not exercise the Right to Buy because the freehold price is too high.

How will LVR reduce farmland prices?

The introduction of LVR will end speculative investment in farmland. Farmers who currently try to maximise their riches by maximising the area of land they own will minimise the area they own to maximise profits and minimise the amount of LVR they have to pay. This will increase the area of land available to be farmed by newcomers to farming who currently cannot afford to acquire land.

Rural Employment

The number of occupiers of farm holdings has fallen by 1,952 in the last ten years, an indication of the reduction in the number of smaller farms which have been taken over by larger farm businesses.

There are several farms in our neighbourhood which were owner-occupied when we moved to Fife in 1992. They are now part of larger farm businesses, some have been bought and the rest are farmed under contract. Conventional wisdom says that these smaller farms had to be taken over because their size was insufficient for them to be financially viable. The following description of one of the farms shows that this statement is untrue.

The farm has 185 acres with a good farmhouse. The farmer grew wheat and potatoes and kept cattle and sheep. He had inherited the farm from his father and I believe that he had no debt. It appeared that sufficient profit was made to afford a comfortable living. It was financially viable as an independent farm but ceased to be so when it was bought by a large farm business because its price was £1.2 million. Its price based on the 20 x rent formula would have been £314,500. It is their high market price which makes many smaller farms unviable, not their lack of potential to provide a living for a family.

There are no official statistics of the number of farm holdings which are farmed by large farm businesses but the number and size of holdings in Scotland is worthy of attention. There are 52,740 holdings with an average size of 261 acres; 8% have an average of 2,350 acres and account for 76% of the total farmland area; 40% have an average of 146 acres and account for 22.2% of the area and 52% have an average of 8.3 acres and occupy 1.6% of the farmland area. Many but not all of the smaller farms are farmed part- time but there is scope for their number to increase when LVR is introduced and land becomes available from existing larger farms. A comparison with countries in the rest of Europe shows that the structure of farming in Scotland is exceptional. The average size of farms in the EU27 is 54 acres and farms between 86 and 135 acres are classified as Big. Medium sized farms have between 50 and 86 acres and Small farms between 17 and 50 acres. The average farm size in Scotland is almost five times that in the EU27. Within the UK it is more than twice the average in England and two and a half times that in Wales and Northern Ireland. There is scope for there to be many more farms and independent farmers in Scotland.

The number of people employed in farming continues to decline. Between 2004 and 2014 the regular workforce has fallen from 63,832 to 59,636, a drop of 4,196. The data from our farm indicate why this is happening. We employ two full-time staff and each has an annual gross income of about £31,000. Their take –home pay is £20,500 and we send £10,500 for each to HMRC every year. In other words, we employ two staff and send the take- home pay for another to the government!

Contrast this with what happens when we buy another tractor. The investment allowance is an attractive incentive to buy more farm machinery. It should not be surprising that the size of tractors is increasing and the number of employees is falling.

There is no shortage of work to be done on farms and the abolition of income taxes following the introduction of LVR will allow more people to be employed. Not only will the cash costs be reduced but also the costs of stress associated with complying with the outdated and complicated employment tax laws. Think of the relief and the ability to concentrate on the job of farming! We should try to become reasonably rich by farming the land, not trying to become unreasonably rich by owning as much land as possible to maximise our ability to capture the unearned increase in its market price.

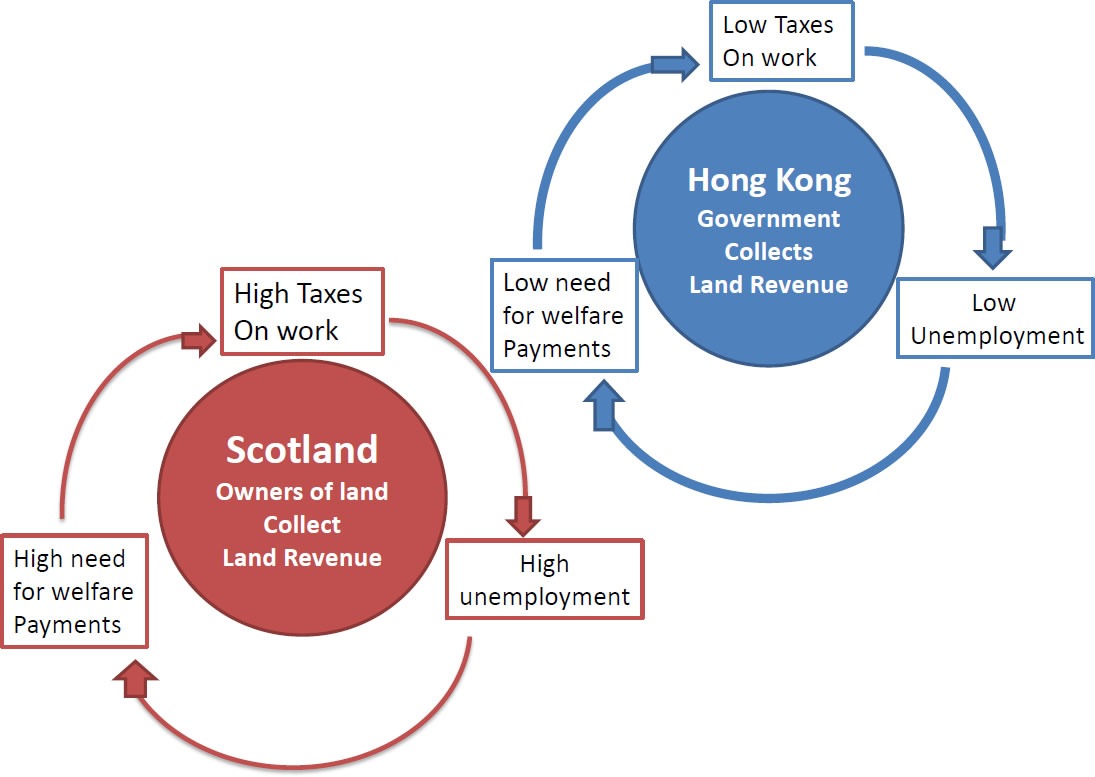

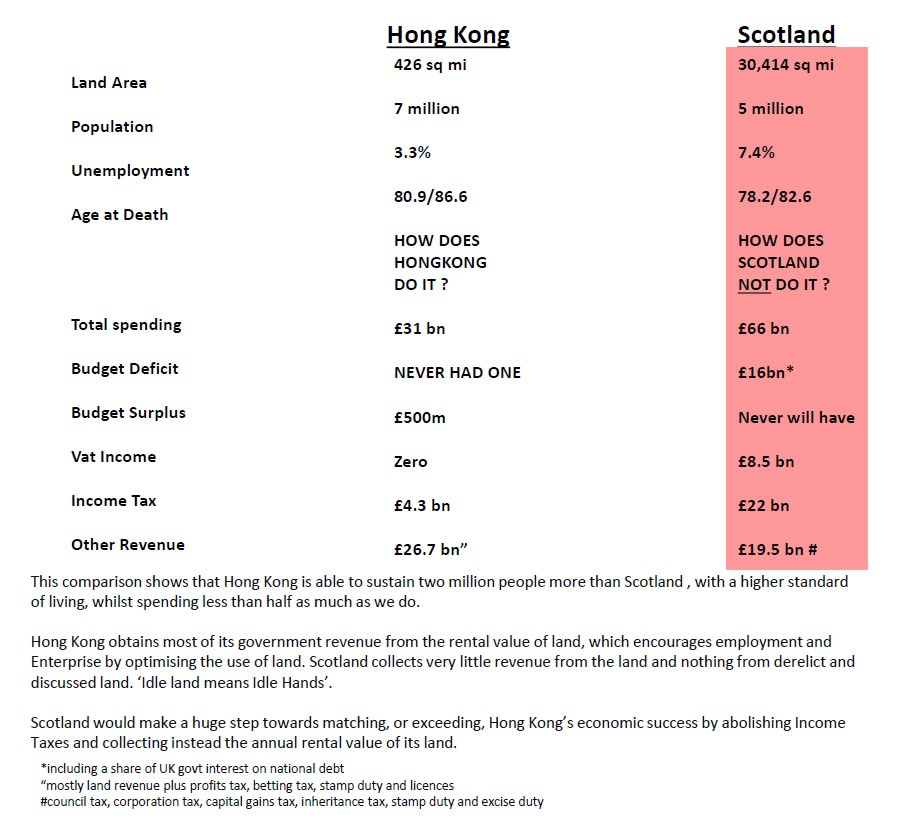

The example of Hong Kong is worthy of study. This comparison should make every person in Scotland ashamed to see how far behind we are. That barren rock has to import all its food, fuel and raw materials with 2 million more people having a higher standard of living than those of Scotland, which has seven times more land and is rich in natural resources. My last slide shows what Scotland could do by adopting, and improving on, the economic policy of Hong Kong. May I draw your attention to the person responsible for this. She is my ten year old granddaughter and another reason for wanting to pay the rental value of my land to the government. I support the case for radical land and tax reform to end the immoral accumulation of national debt which will be left to be paid by future generations. There is now an opportunity stop pretending that a promise to pursue the failed tax policies of the past, but to pursue them better, will lead to the level of prosperity which our country has the potential to achieve.

Articles

Land Value Tax Links

The Tax Burden

Article List

- Welcome

- SA 88. Is there another way? by Tommas Graves

- SA 87. Time for a look at Rent by Tommas Graves

- SA 86. It’s rather Odd………….. By Tommas Graves

- SA85. Born to become a Georgist by Ole Lefmann

- SA84. Happy Nation by Lasse Anderson

- SA83. Ulm is buying up land, sent by Dirk Lohr

- SA82. Radical Tax Reform by Duncan Pickard

- SA 81. All taxes come out of Rents, by Rumplestatskin.

- SA 80. The Housing Crisis and the Common Good, by Joseph Milne

- SA 79. The “housing crisis” is no such thing, by Mark Wadsworth

- SA78. The Inquisitive Boy by “Spokeshave”

- SA 75. A Note on Swedish Taxes, by Tony Vickers MScIS MRICS

- SA 74. Homes Vic by Emily Sims

- SA73 Public Revenue Without Taxation by Peter Bowman

- SA71. Two presentations by Ed Dodson

- Short Sighted Benevolence

- SA 72. CAN YOU SEE THE CAT?

- SA70. Dissertation on Land Rental by Marion Ray

- Verses on the theme

- SA69. Argentina by Fernando Scornic Gerstein

- SA68. The Right to Work, by Leslie Blake

- SA66. The Most Wonderful Manuscript by Ivy Akeroyd 1932

- SA65. Housing Crisis? What Housing Crisis? by Mark Wadsworth

- SA64. Making Use of History by Roy Douglas

- SA63. The Fairhope Single Tax Colony – from their website

- TP35. What to do about “The just about managing” by Tommas Graves

- SA62. A Huge Extra Resource, by Ed Dodson

- SA61. Foundations of Earth Sharing Why It Matters: By Lawrence Bosek

- SA60. How to Restore Economic Growth, by Fred Foldvary, Ph.D.

- Two cartoons by Andrew MacLaren MP

- SA59. The Meaning of Work, by Joseph Milne

- SA 58. THE FUNCTION OF ECONOMICS, by Leon Maclaren

- SA 57. CONFUSIONS CONCERNING MONEY AND LAND by Shirley-Anne Hardy

- SA 56. AN INTRODUCTION TO CRAZY TAXATION – by Tommas Graves

- SA 55. LAND REFORM IN TAIWAN by Chen Cheng (preface) 1961

- SA54. Saving the Commons in an age of Plunder – by Bill Batt

- SA53.- Eurofail – VAT, by Henry Law

- SA52. Low Hanging Fruit – by Henry Law

- SA51. Location Theory and the European Union, – by Peter Holland

- SA50. Finland’s Basic Income – why it matters by Fred Foldvary, Ph.D.

- SA 29. A New Model of the Economy, by Brian Hodgkinson, as reviewed by Martin Adams of Progress.org

- Economics Explained (In 1 Simple Cartoon)

- SA 48. LANDED (Freeman’s Wood) by John Angus-StoreyG2

- SA 47. Justice and the Common Good by Joseph Milne

- SA 49.Prosper Australia – Vacancies Report

- SA39. A lesson from Alaska: further thoughts? By Alanna Hartzog

- SA23. Taxation: a brief history by Roy Douglas

- SA45. Of course, it wouldn’t solve all problems………by Tommas Graves

- SA43. TIME TO CALL THE LANDOWNERS’ BLUFF by Duncan Pickard

- SA44. Answering questions to UN Habitat 3 Financing Urban Development by Alanna Hartzog

- SA15. Why we don’t have a Housing Shortage, by Ben Weenen

- SA27. Money and Natural Law, By Tommas Graves

- SA42. NO DEBT, HIGH GROWTH, LOW TAX By Andrew Purves

- SA40. High Land Prices and Rural Unemployment, by Duncan Pickard

- SA28. Economics is a Natural Science by Duncan Pickard

- SA34. Economic Answers to Ecological Problems by Seymour Rauch

- SA22. Public Revenue without Taxation by David Triggs

- SA41. WHAT FAMOUS PEOPLE SAID ABOUT LAND contributed by Frank de Jong

- SA36. TAX THE RICH? Pikety and all that……..by Tommas Graves

- SA46. LAND VALUE TAX: A VIABLE ALTERNATIVE By Henry Law

- SA35. HOW CAN THE ECONOMY WORK FOR THE BENEFIT OF ALL? By Peter Bowman, lecture given at the School of Economic Science.

- SA38. WHO CARES ABOUT THE FAMILY by Ann Fennell.

- SA30. The Turning Tide: The Beginning of Monetary Trade in Anglo-Saxon England by Raymond Makewell

- SA31. FAULTS IN THE UK TAX SYSTEM

- SA33. HISTORY OF PUBLIC REVENUE WITHOUT TAXATION by John de Val

- SA32. Denmark By Ole Lefman

- SA25. Anglo-Saxon Land Tenure by Raymond Makewell

- SA21. China – Four Thousand Years of Taxing the Land by Peter Bowman

- SA26. The Economic Philosophy of Georgism, by Emma Crosby