SA13. DEBT IS INEVITABLE unless……by Tommas Graves

DEBT IS INEVITABLE – UNLESS WE CHANGE OUR WAYS.

“Some men work to maintain others who labour not. That is unjust.”(1)

Tommas Graves December 2011.

The quest for a fair distribution of wealth becomes obligatory if we consider the following questions;-

How does it come about that a few get rich, while the many stay poor?

Why should this be getting worse in the face of an enormous increase in production?

What is the origin of the financial crisis?

Why is corruption so widespread?

What forces lead individuals and governments into debt?

So, let us go back to the beginning of things.

The human condition is that he/she has needs and desires which can only be satisfied by work. The amount of work that an individual is prepared to do is the measure of the satisfaction gained. He works with the free resources of nature. These resources are primarily abundant. All is set for an idyllic existence, with work lightly measured, with the help of abundant nature, leading to realisation of mans highest potential. (Adam Smith – “Labour, therefore, is the real measure of the exchangeable value of all commodities”.)

But, you will say, it is not like that!

So why is it not?

Man works with the resources of the land he lives on, the planet earth. The natural resources of land (the earth) include sunshine, air, water, and land in the sense of just the solid ground, animal life and vegetation. In early times these resources were freely available – in fact, are free. (2) From earliest times human beings worked together in groups in order to satisfy their desires in the easiest and most efficient way. Hunting and gathering in tribes they naturally shared the product of their work. Then they found that, because there was now a growing community, specialisation was possible. This led to greater efficiency, but it also led to the need for exchange. The shoemaker could not eat his shoes! So markets developed, and in time, money, e.g. means of exchange.

So, step by step, the nature of man evolves, alongside the free use of the resources of nature.

With the advent of farming, land had to be enclosed, in order to protect and bring to fruit the crops or herds being nurtured. After a few generations living and working on the same plot, that it was natural for that family or tribe to think of that plot as “theirs”.

And so the enclosed areas became “owned”. But there was plenty of free land, and until Saxon times in England, there was recognition that land was held by consent of the community, and not owned outright.

William the Conqueror took it for granted that victory in battle had made the land of England was “his”, to dispose of as he wished and he distributed it in pieces to his barons, who likewise apportioned it to their followers. So started one thousand years of land enclosure. Work on land had to continue, of course, but

2.

now those who worked found that the “owners” wanted a share of the product. And, bit by bit, the responsibilities of landowners towards the king were watered down, giving rise to the need for taxation in place of duties.

This is a potted history of economic affairs, especially as England is concerned. (4)

Natural resources, including land, are still free, but we have found a way in which “Some men work to maintain those who labour not”, and the injustice is obvious.

So now the product of work is distributed in three ways.

(a) The reward for work – net wages less indirect taxes.

(b) Taxation

(c) Rent

We shall consider these in turn. But before we do so, what of the rest of the world?

Because of trade and empire building, we in the UK have exported the idea of land ownership to many parts where land right were far more fluid, where the idea of Mother Earth still obtained. We were aided and abetted by tyrants and despots who saw that their power resided in control of land in their domains. So, in most parts of the world, there is a small landowning class surrounded by a population living in various degrees of poverty. This poverty is alleviated by varying amounts of taxation, mostly raised from that population.

Now let us study some of the effects of the above in the world today. In particular we can highlight certain trends emerging in recent years.

THE RISING TIDE THAT LIFTS ALL BOATS?

An early piece of news that alerted us appeared in an article called “The Growth Conundrum” in The Economic Research Council digest Vol. 39, No.3. “US government statistics indicate that from 1960 to 2005, GDP per capita more than doubled, while real median household income has essentially stagnated rising only 15% over the entire period. This trend, if it continues, could undermine public confidence; and not only in the linkage

between economic growth and living standards, but in the capitalist system itself.”

3.

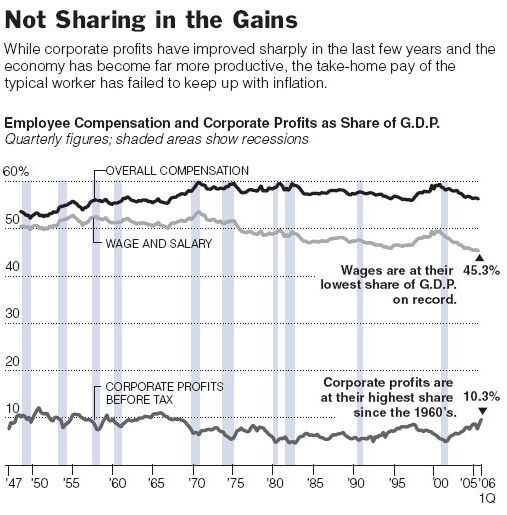

A further chart in the New York Times further makes the point that as a share of GDP wages are at their lowest since 1947, whilst corporate profits are at their highest since the 1960s.

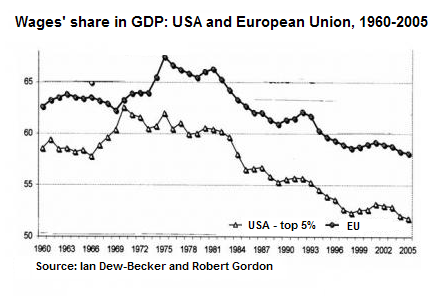

At http://en.internationalism.org/ir/133/china/graph3 it is shown that wages as a share of GDP in the EU has been declining since 1969. It seems to be a world wide phenomenon, and has been described as the knowledge revolution, that is extra productivity brought about by computers and communications.

At http://www.measuringworth.org (click for graph) it is shown that UK Real GDP per Capita has tripled between 1960 and 2008 (shown in year 2003 pounds).

4.

RISING TIDE ONLY FOR SOME!

So the question that must be put is “Where does all the rest go?”

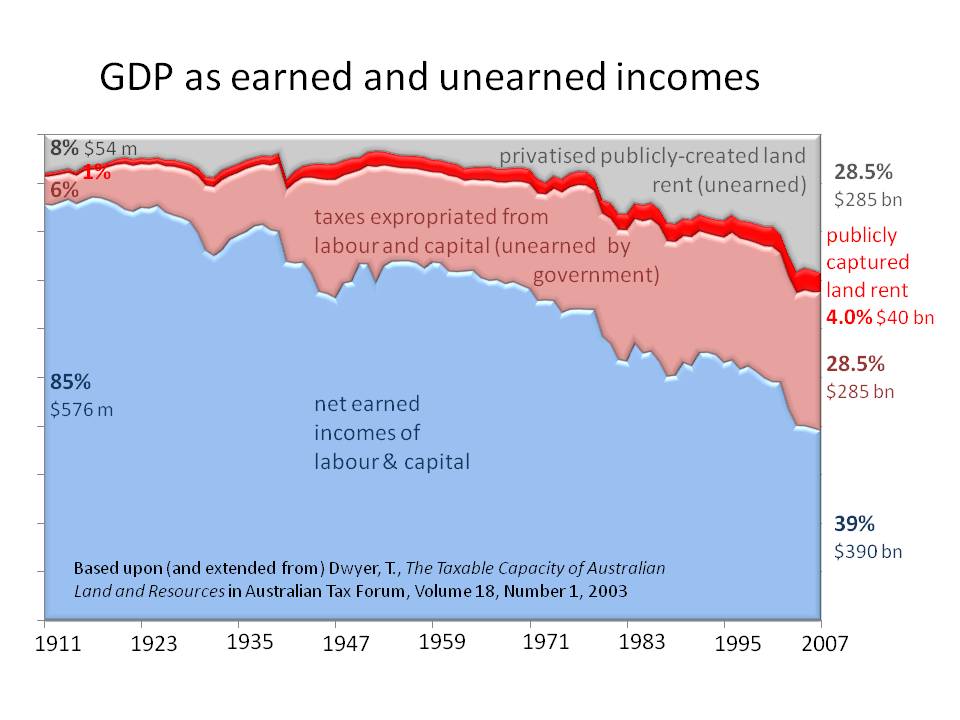

A particular vivid part of the answer is provided by Bryan Kavanagh in Prosper Australia. This may be viewed at http://www.prosper.org.au/2009/01/28/ineffective-demand/ . Here the decline in the share of GDP in Australia since 1911 is shown, but the rest of GDP is also shown as Taxes and Rent.

The commentary shows how a badly designed tax system has finally choked off effective demand.

Now, we might speculate that most of net wages is spent on just living. Taxation is spent on the services a

community needs, and alleviation of poverty. But rent is surely not needed for living, and most will be spent

on the acquisition of “assets”, possessions that are likely to keep or increase their value in the future.

Is the increase in rent the cause of the “asset price hike”?

In the State of Victoria, Australia, the number of years net salary required to buy the median house of all sales in the Melbourne Metro Area has increased from 4 in 1970 to 9 in 2007. (125% increase), whilst net wages in the same period have grown from $2500 to $30000, (1100% increase), land prices have grown from $2500 to $145000 (5700% increase). In these figures we get a glimpse of the pressure on asset prices (mostly land).

Rent is paid for the occupation of both buildings and the sites they stand on. Rent for the occupation of a building is a valid charge because the owner has constructed it or paid the person who did that, but no human being has constructed a site and its value is conferred by nature and by the work of a whole community. Rent paid for the privilege of occupying a site simply provides the landowner with unearned income.

We must also remember that all these charts will paint a picture not as bad as the real situation. This is for two reasons;

- Net wages include the vast sums paid in bonuses and salaries in banks and similar institutions, which are really a distribution of rent.

- Much rent, especially in city centres, is paid to corporations, which effectively translate it into salaries, dividends and profits.

5.

AS FORECAST

Those who have read “Progress and Poverty” by Henry George will know that he precisely forecast what has happened. Here is a quote from Chapter 22 taken from the simplified version which can be viewed at http://www.henrygeorge.org/pchp22.htm .

As population grows and technology advances, land values rise. This steady increase leads to speculation, as future increases are anticipated. Land values are carried beyond the point at which labor and capital would receive their customary returns. Production, therefore, begins to stop.

As population grows and technology advances, land values rise. This steady increase leads to speculation, as future increases are anticipated. Land values are carried beyond the point at which labor and capital would receive their customary returns. Production, therefore, begins to stop.

Production need not decrease absolutely – it may simply fail to increase proportionately. In other words, new labor and capital cannot find employment at the usual rates.”

WE DID IT OURSELVES!

It will be noticed in the Australian chart that the top portion is described as “privatised publicly-created land rent (unearned)”. If it is publicly created, whom does it belong to? Here we can see an alternative method of providing public goods and services. We simply give back to the community what it has created. The result would be that we no longer need to tax production.

At present, in Britain the cost of wages is approximately double the “reward for Work” having stripped out all direct and indirect taxes. Calculation and a chart may be viewed at http://www.landisfree.co.uk/EmployersBurden2011-12.pdf

A brief consideration of this will show the enormous damage being done by our present tax system. In the first place, the employers value of the work done will be rather different from the employees. But also, this amount of taxation levied at the margins will put many sites out of use. This heaps more burdens on taxpayers, for unemployment pay and benefits, so we get a downward spiral as extra tax forces yet more businesses out of production.

And it is entirely voluntary! There is another way of doing it. A way that returns to the community what it creates, and leaves the individual with the product of his/her work.

But what we have instead is that part of the product is transferred from those who work to those who do not. No wonder we are in such a mess!

How the product of work is distributed.

First we must refine our definitions to make our argument plain.

(a) The reward for work. Here we mean take home pay less indirect taxes spent out of it.

(b) Taxation. This is all forms of taxation direct and indirect., The largest element, which is PAYE and National Insurance either added to wage costs or deducted to arrive at take home pay.

(c) Rent. This is the charge made for access to a site or use of any of nature’s raw materials.

These three claims to the product of work are necessarily antagonistic to each other. The product first falls into the hands of the firm, but as land has become all enclosed, wage earners choice is restricted by the fact that there is no free land. The employer on the other hand has the pressing claims of taxation and rent to pay, so that wages are pushed down. How far? As far as the living costs of the employees will let it.

6.

Rents will be the maximum the owner can charge given conditions at the time, and taking into account the length of the lease proposed.

It has been shown that when taxation is introduced into the claims of wages and rents, first it reduces wages to the minimum acceptable, then it eats into the rent. (3)

As noted above the largest element of taxation is directly related to wage costs. Consider the latest UK budget.

UK GOVERNMENT TAX COLLECTION AND SPENDING 2011/12

(BUDGET March 2011) – Source HM Treasury

(i) Revenue:

Income tax: 158 bn

National insurance: 101 bn

VAT: 100 bn

Corporation tax: 48 bn

Excise duties: 46 bn

Council Tax 26 bn

UBR: 25 bn

Other receipts 85 bn TOTAL: £ 589 bn

From the above, we can see that the first two items are collected through the wages system (PAYE) and self employed people. VAT is largely met by those same people as they spend their take home pay, and this will apply to much of Excise duties as well. So that, some two thirds of our current taxes are applied as a cost to business by being added to wages. It can be shown that the cost of wages is about double the actual reward for work Link to Employers Burden Information

The effect of this arrangement is that wage intensive businesses are taxed more heavily than businesses that rely on equipment and machinery. This results in a disincentive to employment. We can see the results of this, in that many heavy industries have left the UK, the number of people employed in agriculture is now very small, and all businesses are trying to cut costs by moving their production to countries with lower taxes as applied to wages.

As businesses go out of business or move abroad, we are left to pick up the pieces.

UK GOVERNMENT TAX COLLECTION AND SPENDING 2011/12

(BUDGET March 2011) – Source HM Treasury

(ii) Expenditure

Relief of poverty Public services Other

Social Services 232 Law and order 33 Interest 50

7.

Health 126 Defence 40 Other 74

Industry, ag, employment 20 Transport 23

Housing & Environment 24 Education 89

TOTALS 402 185 124

Of the total of £710bn, 56% is spent on alleviation of the effects of our tax system.

What follows is a simplified set of diagrams to show how our tax system damages the economy.

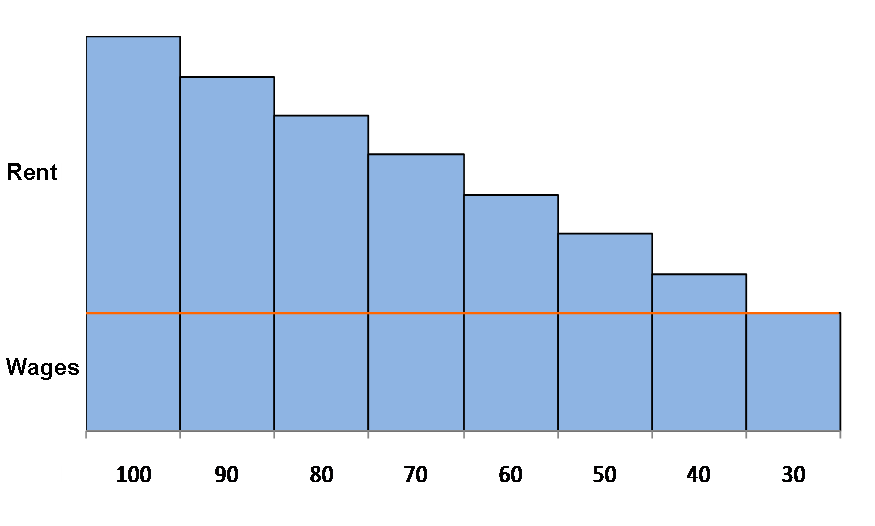

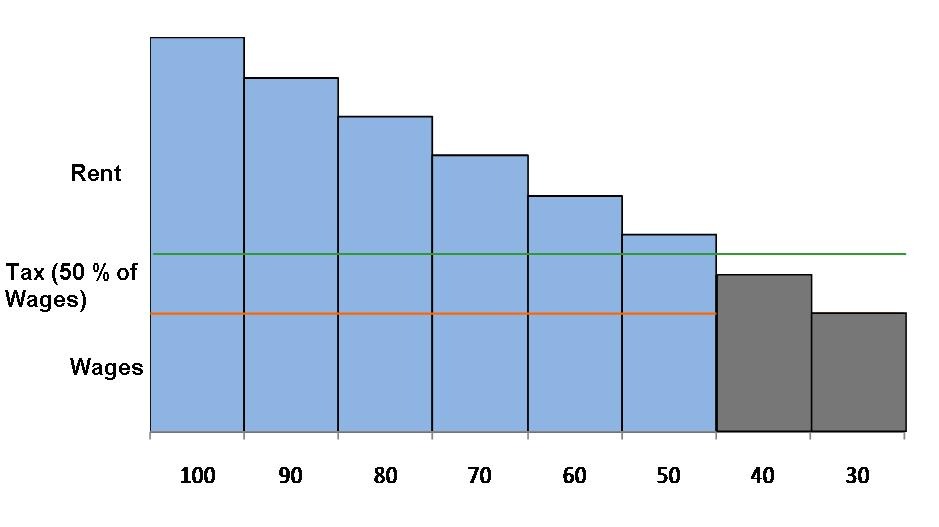

Diagram 1. Eight similar sites in size and labour applied, but with differing advantages such as infrastructure, Transport, fertility, and other factors external to the sites themselves, leading to greater or less productivity, or “added value”.

The level of wages will be set by the least productive site, and the excess is termed economic rent.

Diagram 2. Now tax has been applied at 50% of wages. Two sites have gone out of business, and another is just hanging on. Much of the taxes have to be spent on keeping those from the two sites from starvation.

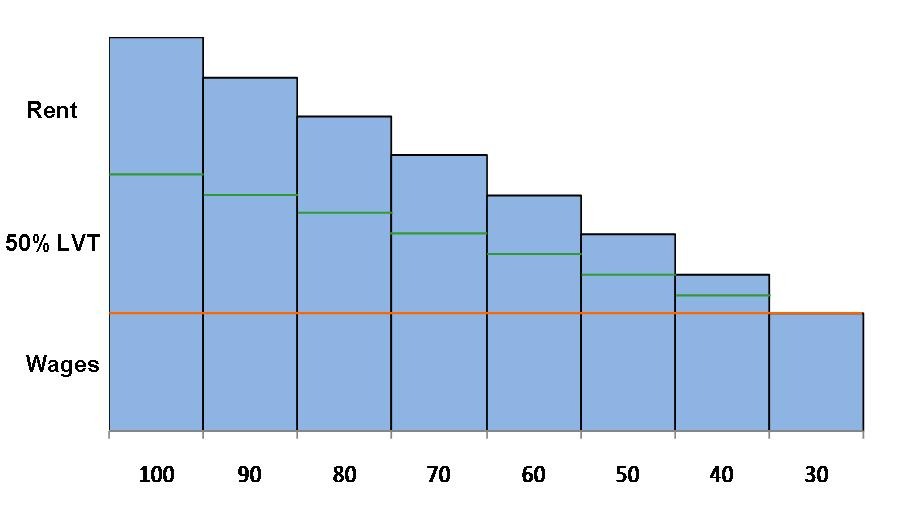

Diagram 3. Tax has been applied, instead of the previous taxes, at 50% of rent. Sites 7 and 8 stay in business, and no tax is required in amelioration of poverty.

8.

We can see that the incidence of taxation can cause unemployment. This factor, plus the low wages make it impossible for employees without special talents to meet their obligations to their families. But there is a third pressure on them.

The charge for access to a site or use of natural resources falls into the hands of those who claim to own the resources. This income stream becomes represented by a capital value. So the price of land gets added to the cost of a house. The only way the wage earner, whose wages are pushed down, can possibly purchase a house is by taking out a mortgage, which, with accumulating interest, may take him 30 to 50 years to repay.

But now we come to the final irony.

The rent that can be charged only comes about from the differential values arising on the use of natural resources, according to ease of access, fertility of soil and prevailing conditions of all kinds. There is nothing that the owner, per se, has done to yield this rent. In addition, as a community grows, it makes improvements, infrastructure etc, to which the landowner makes no contribution as a landowner. So the whole of the rent is created by the community as a whole, and thus the natural source of public revenue is the rent.

And if this was collected by the community there would be no need for taxation, and the damage caused by taxation would be eliminated, and the reward for work would rise to the product of work. As owners would not receive rent, ownership would have no value, – back to the free resources of nature. A family could meet its obligation without enormous debt. A nation could meet its obligations without sovereign debt caused by expenditure in excess of revenue to ameliorate poverty. As rent becomes directed to its natural use, the source of much corruption is removed. And on top of all that, the concentration of wealth in a few pockets has led the banks to serve these few rather than all, credit has been supplied for asset purchase instead of improvement to businesses, leading to greed and neglect of good banking practices.

Thus, we can see that the concept of ownership of that which is free has caused all sorts of mischief!

And the mischief is growing. Year by year, more of the product of work is accumulated by those who are in receipt of rent. The “haves” are always gaining at the expense of the “have-nots”. The tax system is not designed to create justice. As the “Times” leader said, “If you make a billion in UK, you will be led to Monaco, while if you make a billion almost anywhere else, you will be led to South Kensington!” The need for a remedy grows more urgent.

Hong Kong

An illustration of what is possible is provided by the experience of Hong Kong. There the average wage is £9230, compared with UKs £27000. But if taxes, both direct and indirect are stripped out, the UK figure comes down to £16200 and the HK figure is £9200. This is made possible by the Land Auction Sales. By a historical anomaly, all land is held by the government, and it is auctioned in leases of up to 75 years, and when the term is finished the land is released to the highest bidder. By this means a large part of “public value” is transferred to the government each year. In other respects, more of their taxes are based on business profits, and much less on Income tax, that is, on wages.

One result of this approach is that Hong Kong has a sovereign wealth fund of £204billion in 2011, whereas in UK we have a sovereign debt of £967billion before counting financial sector interventions.(5)

9.

To summarise;

We work to fulfil our needs and desires, the amounts of work measures our desire for fulfilment. But the product of co-operation produces extra wealth over that produced by individual effort. This extra product is taken by those who claim to own land. So taxation is necessary. This reduces the reward for work, so that going into debt is seen as part of the natural reward for work done.

Taxation is levied largely in proportion to wages, so that high wage industries or marginal activities are put out of business. Further taxation is needed to alleviate poverty caused by the tax system. Taxation cannot be raised to cover all the necessary outgoings. So governments borrow. They borrow largely from those who have claimed the extra product produced by the community as a whole. Interest gets added to the transfer from the week to the strong. The strong get richer. The net closes. How long before we see sense?

The Remedy

From the foregoing it can be seen that there is a link between Rents as now paid and Full Rent as spoken of by Henry George and those who followed him. The link is as follows;-

Rent as now, less rent of Buildings etc ie all works of man on that

site leaving only community created value.

Plus Rent of Freeholds per valuation, on same basis as above

Plus all Taxation especially taxes on wages

Less the amount that Wages have been depressed.

Equals Full Rent

Rent(now) – Rent (bldgs.) + all taxes – Wages (as reduced) = Rent (full)

So, all we have to do is collect rent on a fair basis, and reduce taxes, the rest will adjust by the dynamic of the factors.

But we are unlikely to do this until, as a country, as a world, we recognise the injustice.

Notes

- Leon MacLaren, lecture on Justice 19.12.1951

- http://www.landisfree.co.uk

- Leon MacLaren The Nature of Society – further essays.

- Sir Kenneth Jupp – Stealing Our Land – Vindex 1997 ISBN 1 901647 14 5

- Andrew Purves lecture 5/11/2011.

Articles

Land Value Tax Links

The Tax Burden

Article List

- Welcome

- SA 88. Is there another way? by Tommas Graves

- SA 87. Time for a look at Rent by Tommas Graves

- SA 86. It’s rather Odd………….. By Tommas Graves

- SA85. Born to become a Georgist by Ole Lefmann

- SA84. Happy Nation by Lasse Anderson

- SA83. Ulm is buying up land, sent by Dirk Lohr

- SA82. Radical Tax Reform by Duncan Pickard

- SA 81. All taxes come out of Rents, by Rumplestatskin.

- SA 80. The Housing Crisis and the Common Good, by Joseph Milne

- SA 79. The “housing crisis” is no such thing, by Mark Wadsworth

- SA78. The Inquisitive Boy by “Spokeshave”

- SA 75. A Note on Swedish Taxes, by Tony Vickers MScIS MRICS

- SA 74. Homes Vic by Emily Sims

- SA73 Public Revenue Without Taxation by Peter Bowman

- SA71. Two presentations by Ed Dodson

- Short Sighted Benevolence

- SA 72. CAN YOU SEE THE CAT?

- SA70. Dissertation on Land Rental by Marion Ray

- Verses on the theme

- SA69. Argentina by Fernando Scornic Gerstein

- SA68. The Right to Work, by Leslie Blake

- SA66. The Most Wonderful Manuscript by Ivy Akeroyd 1932

- SA65. Housing Crisis? What Housing Crisis? by Mark Wadsworth

- SA64. Making Use of History by Roy Douglas

- SA63. The Fairhope Single Tax Colony – from their website

- TP35. What to do about “The just about managing” by Tommas Graves

- SA62. A Huge Extra Resource, by Ed Dodson

- SA61. Foundations of Earth Sharing Why It Matters: By Lawrence Bosek

- SA60. How to Restore Economic Growth, by Fred Foldvary, Ph.D.

- Two cartoons by Andrew MacLaren MP

- SA59. The Meaning of Work, by Joseph Milne

- SA 58. THE FUNCTION OF ECONOMICS, by Leon Maclaren

- SA 57. CONFUSIONS CONCERNING MONEY AND LAND by Shirley-Anne Hardy

- SA 56. AN INTRODUCTION TO CRAZY TAXATION – by Tommas Graves

- SA 55. LAND REFORM IN TAIWAN by Chen Cheng (preface) 1961

- SA54. Saving the Commons in an age of Plunder – by Bill Batt

- SA53.- Eurofail – VAT, by Henry Law

- SA52. Low Hanging Fruit – by Henry Law

- SA51. Location Theory and the European Union, – by Peter Holland

- SA50. Finland’s Basic Income – why it matters by Fred Foldvary, Ph.D.

- SA 29. A New Model of the Economy, by Brian Hodgkinson, as reviewed by Martin Adams of Progress.org

- Economics Explained (In 1 Simple Cartoon)

- SA 48. LANDED (Freeman’s Wood) by John Angus-StoreyG2

- SA 47. Justice and the Common Good by Joseph Milne

- SA 49.Prosper Australia – Vacancies Report

- SA39. A lesson from Alaska: further thoughts? By Alanna Hartzog

- SA23. Taxation: a brief history by Roy Douglas

- SA45. Of course, it wouldn’t solve all problems………by Tommas Graves

- SA43. TIME TO CALL THE LANDOWNERS’ BLUFF by Duncan Pickard

- SA44. Answering questions to UN Habitat 3 Financing Urban Development by Alanna Hartzog

- SA15. Why we don’t have a Housing Shortage, by Ben Weenen

- SA27. Money and Natural Law, By Tommas Graves

- SA42. NO DEBT, HIGH GROWTH, LOW TAX By Andrew Purves

- SA40. High Land Prices and Rural Unemployment, by Duncan Pickard

- SA28. Economics is a Natural Science by Duncan Pickard

- SA34. Economic Answers to Ecological Problems by Seymour Rauch

- SA22. Public Revenue without Taxation by David Triggs

- SA41. WHAT FAMOUS PEOPLE SAID ABOUT LAND contributed by Frank de Jong

- SA36. TAX THE RICH? Pikety and all that……..by Tommas Graves

- SA46. LAND VALUE TAX: A VIABLE ALTERNATIVE By Henry Law

- SA35. HOW CAN THE ECONOMY WORK FOR THE BENEFIT OF ALL? By Peter Bowman, lecture given at the School of Economic Science.

- SA38. WHO CARES ABOUT THE FAMILY by Ann Fennell.

- SA30. The Turning Tide: The Beginning of Monetary Trade in Anglo-Saxon England by Raymond Makewell

- SA31. FAULTS IN THE UK TAX SYSTEM

- SA33. HISTORY OF PUBLIC REVENUE WITHOUT TAXATION by John de Val

- SA32. Denmark By Ole Lefman

- SA25. Anglo-Saxon Land Tenure by Raymond Makewell

- SA21. China – Four Thousand Years of Taxing the Land by Peter Bowman

- SA26. The Economic Philosophy of Georgism, by Emma Crosby